Another treat awaited the Malaysian motorcycle media during our tour among Chinese motorcycle manufacturers in China. This time, it was ARIIC where we previewed the ARIIC Touch 250, and ARIIC Gobi 250 during a visit to their factory, while the ARIIC 400GS prototype was revealed at the ARIIC mega party later.

The brand made their first appearance in Malaysia with ARIIC 318 GT earlier this year. Local distributor, MForce Bike Holdings Sdn. Bhd. said that it has been seeing encouraging sales.

Here is the preview of the models we saw today:

1. ARIIC Gobi 250

Named after the Gobi desert which is located inn Central Asia, covering some 1.2 million square kilometres and spanning across southern Mongolia and northwestern China, the bike is the latest addition to adventure scooter segment.

- Powered by a 249cc, single-cylinder, water-cooled engine.

- It produces 22.5 hp @ 7,500 RPM and 23.5 Nm @ 5,000 RPM.

- The engine is mated to a 2-stage CVT with belt final drive.

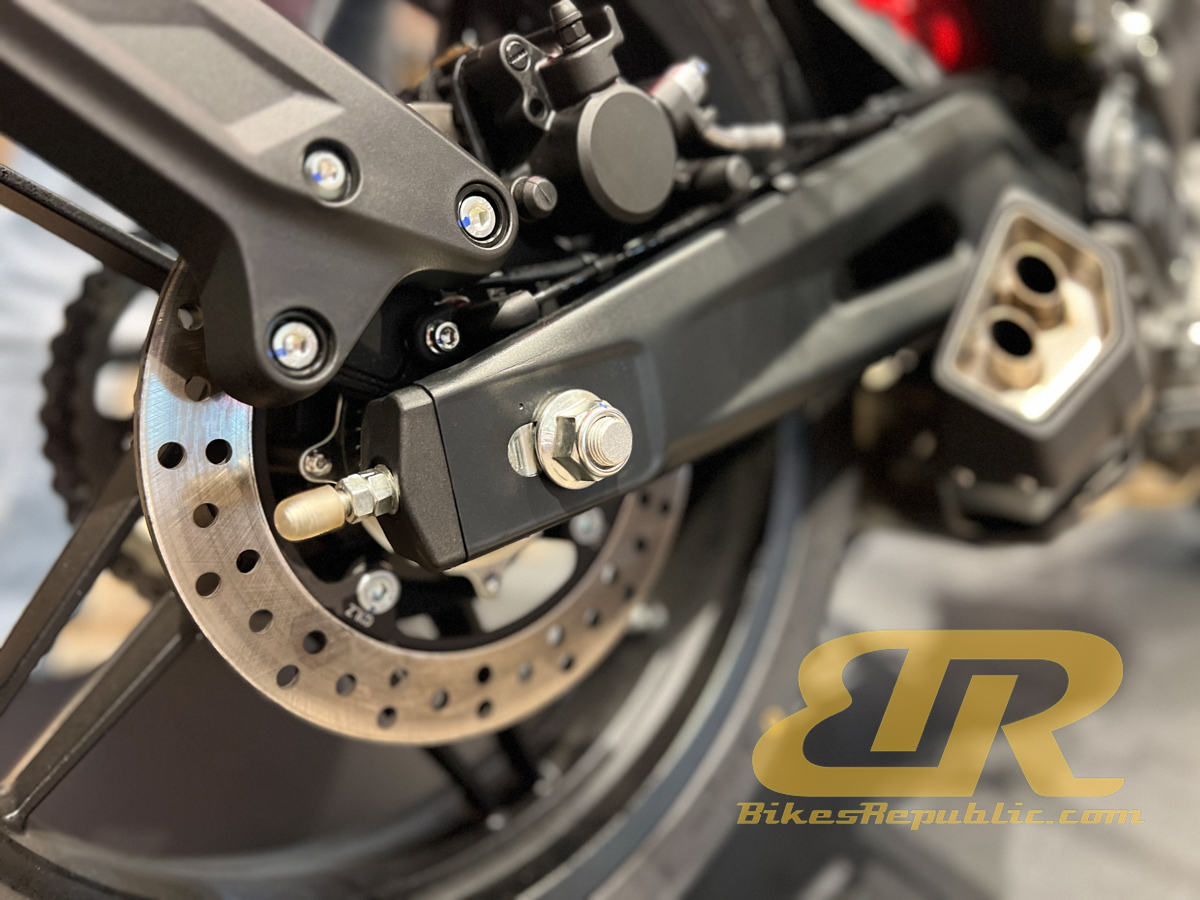

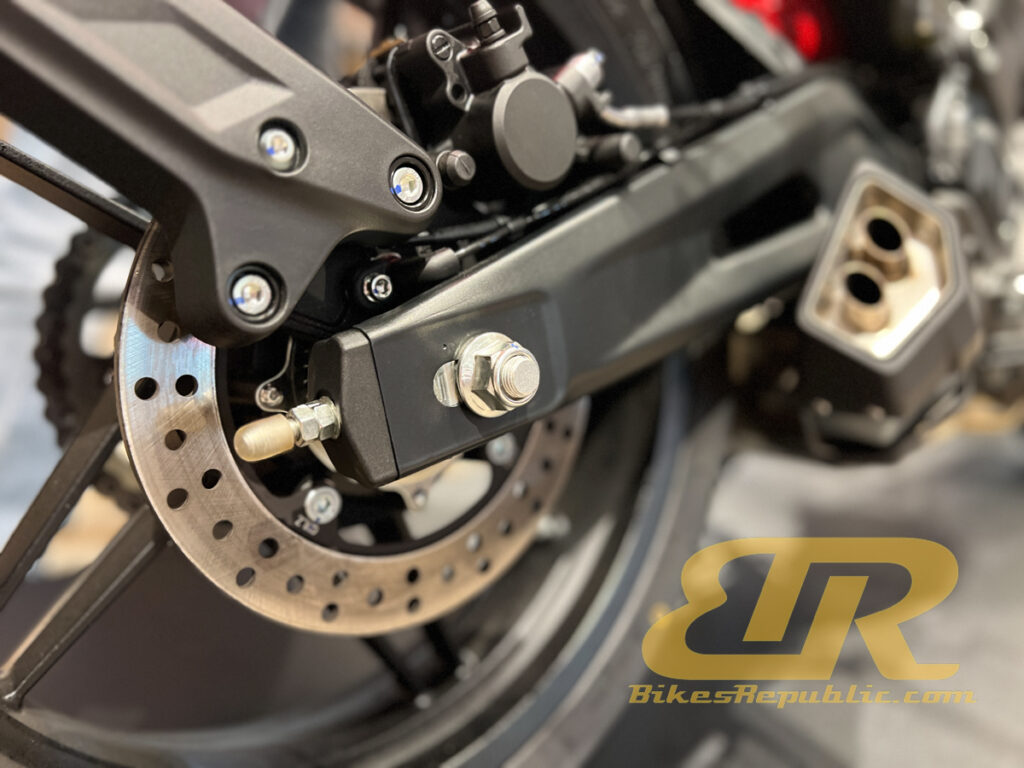

- A dual-channel ABS supports the 240mm front and rear brakes.

- The fuel tank has a 12.5-litre capacity.

- Seat height is 780 mm.

- ARIIC claims a 176kg curb weight.

- Adjustable windscreen which moves by up to 60mm front/back.

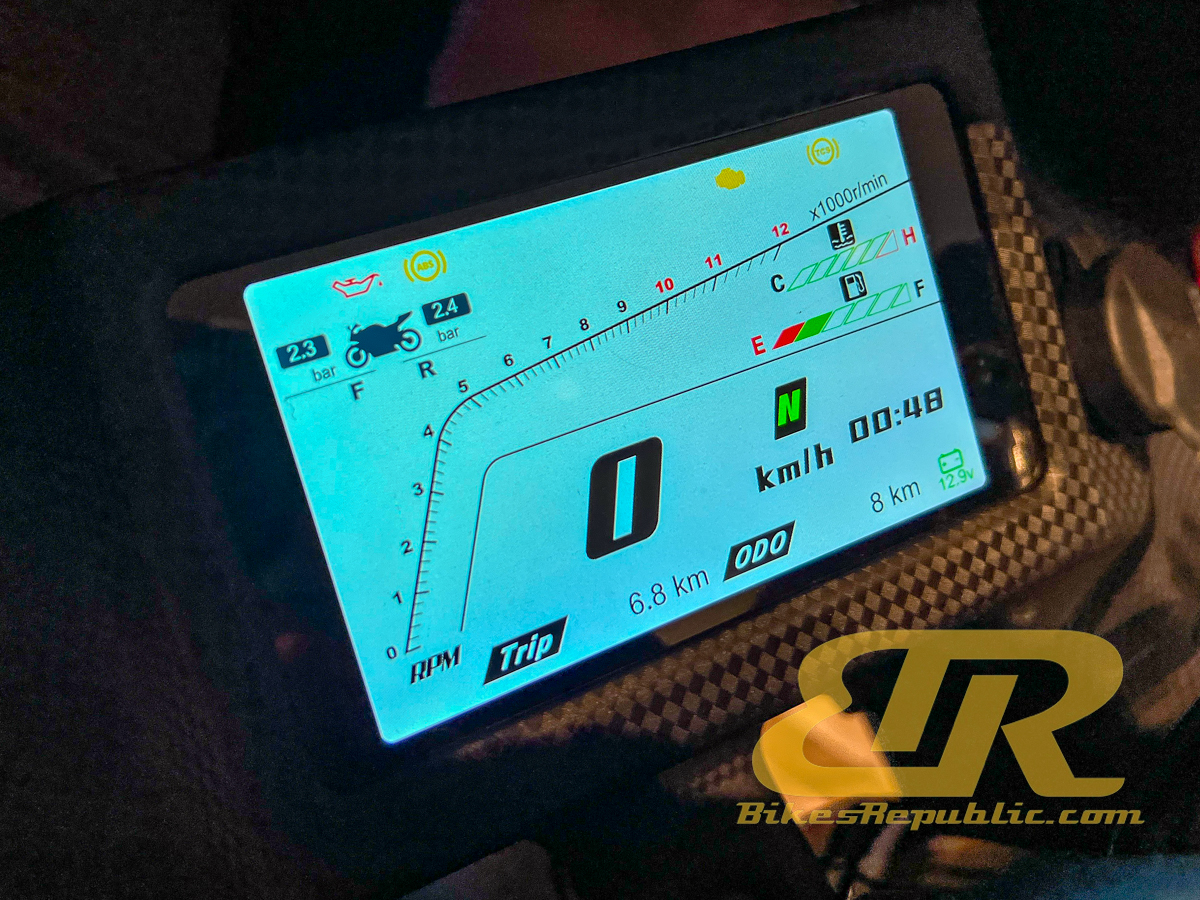

- 7″ TFT screen with smartphone connectivity.

- Front facing dashcam camera.

- One-touch start button.

2. ARIIC Touch 250

Compared to the 318 GT, the Touch 250 is more of an urban scooter, due to its compact size.

- Powered by a 249cc, single-cylinder, water-cooled engine.

- It produces 22.5 hp @ 7,500 RPM and 23.5 Nm @ 5,000 RPM.

- The engine is mated to a 2-stage CVT with belt final drive.

- A dual-channel ABS supports the 240mm front and rear brakes.

- The fuel tank has a 11-litre capacity.

- Seat height is 760 mm.

- ARIIC claims a 147kg curb weight.

- Adjustable windscreen which moves vertically.

- 7″ TFT screen with smartphone connectivity.

- Front facing dashcam camera.

- One-touch start button.

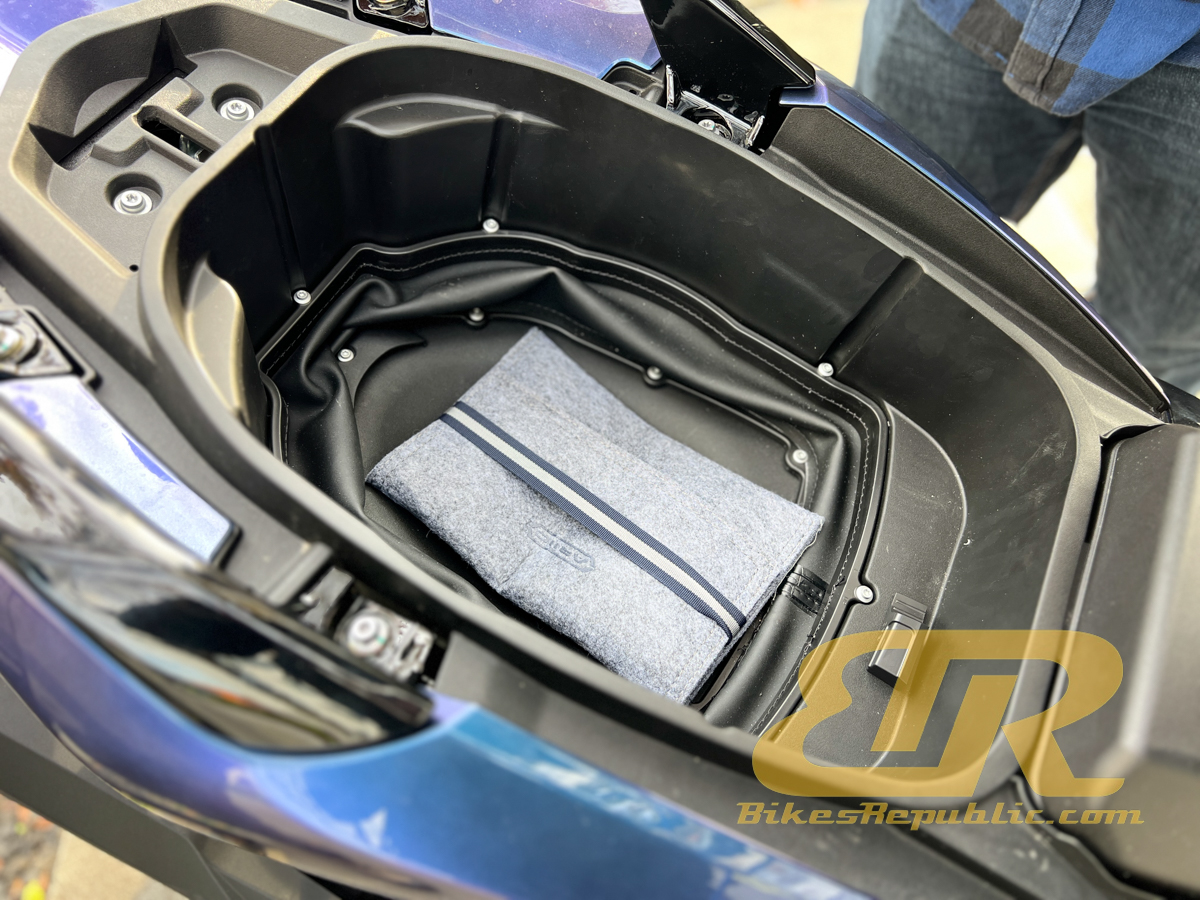

- The most novel feature of this model is the expandable storage space.

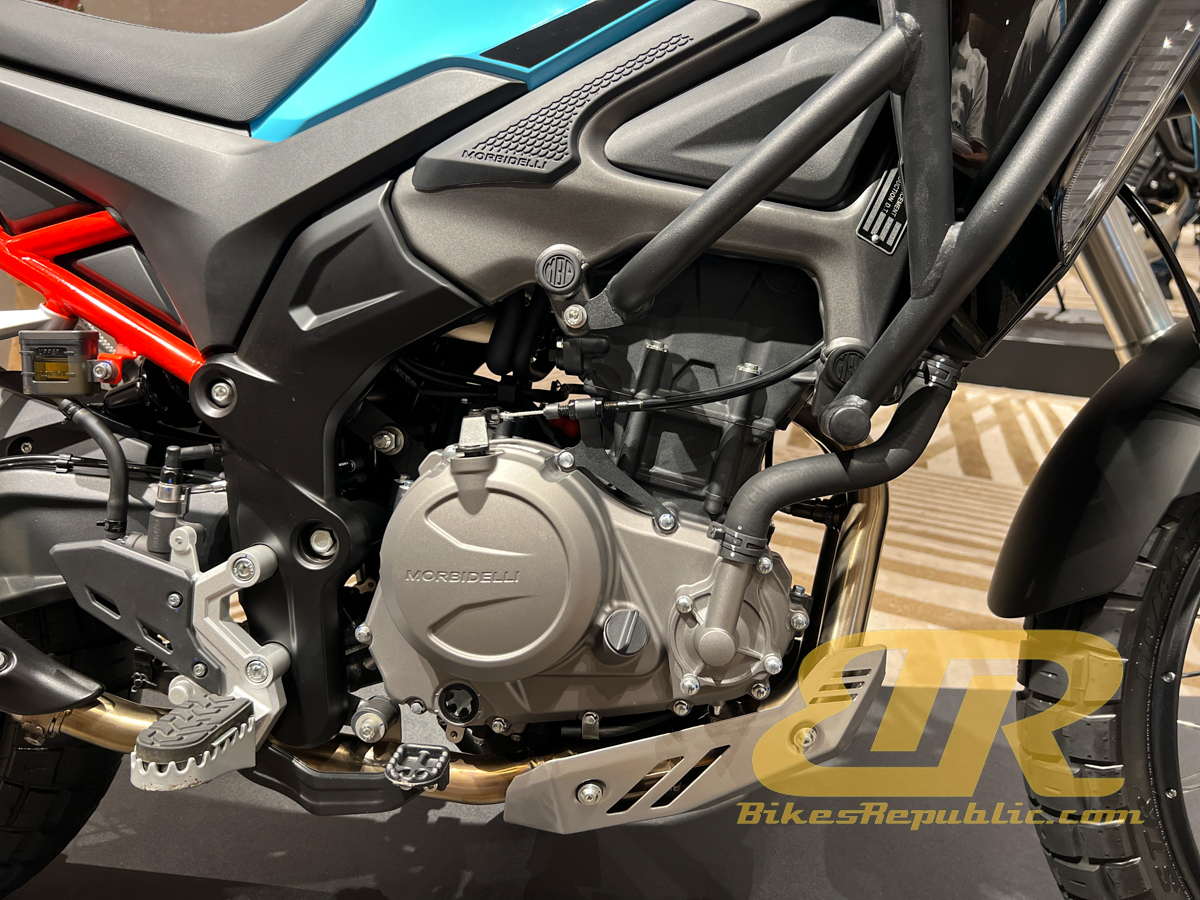

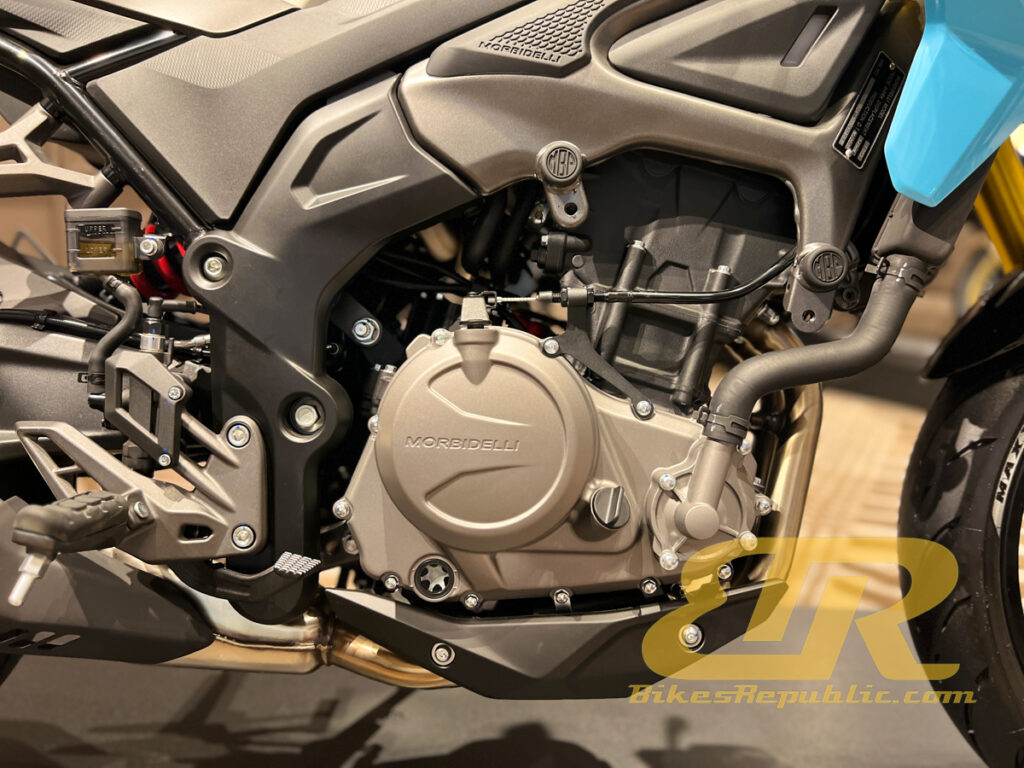

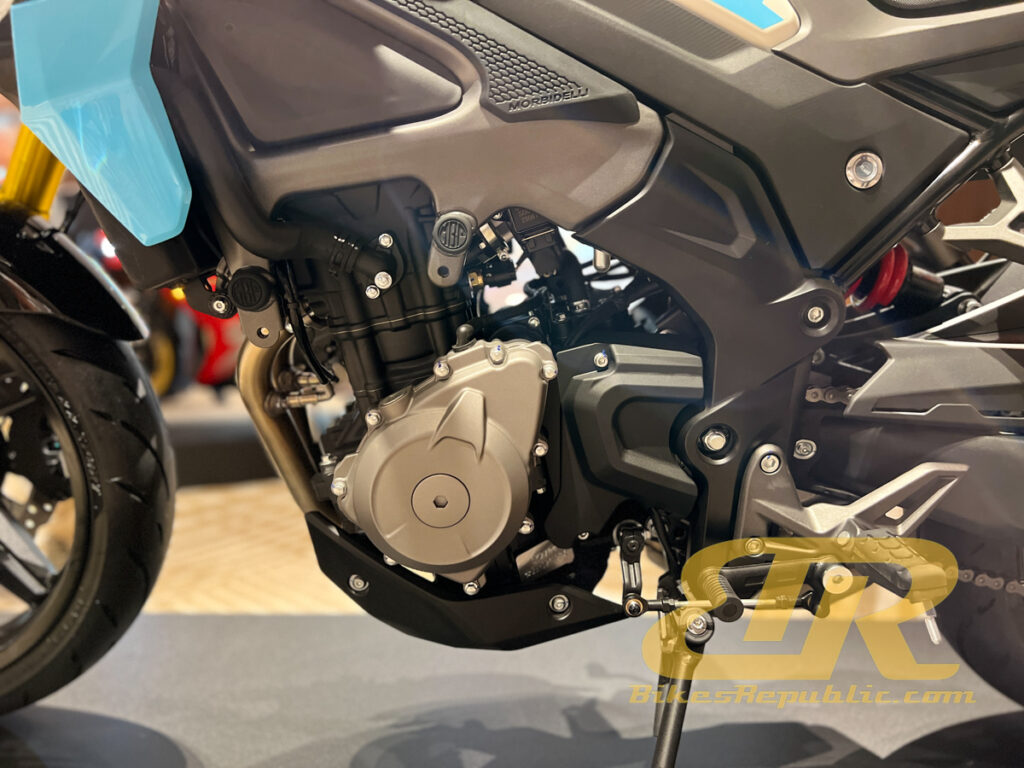

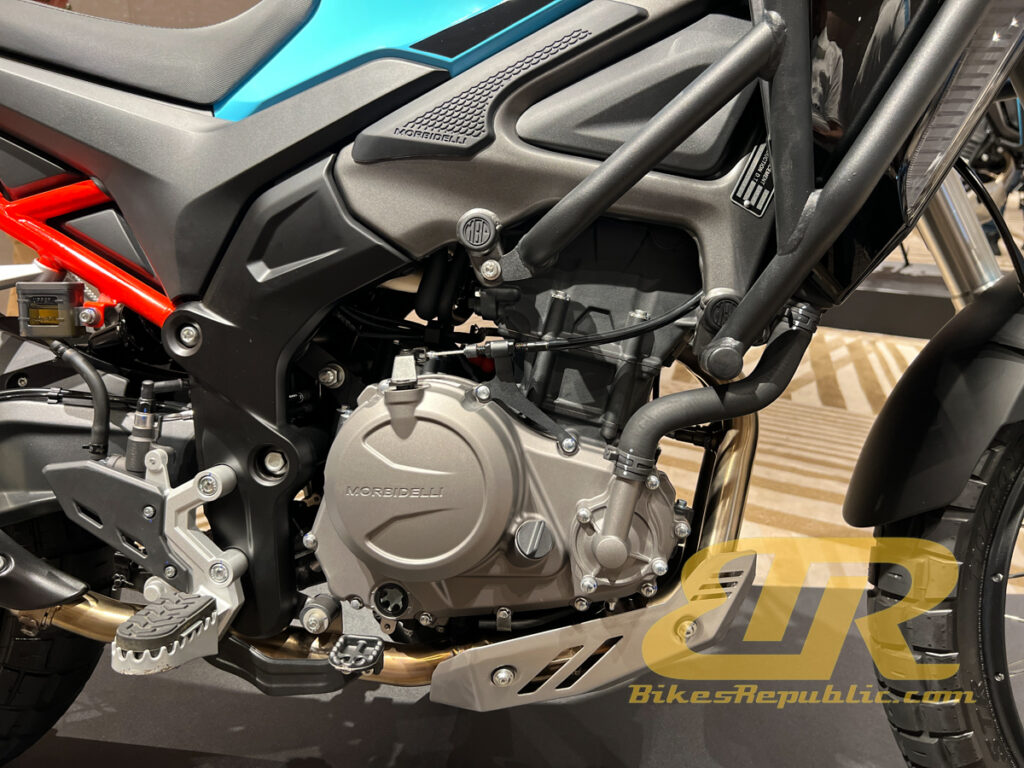

3. ARIIC 400GS

The bike is still in its prototype stage at this moment, although it appears to be almost ready for production. Not much was revealed apart from that it is powered by a 469cc single-cylinder engine.

Interestingly, MForce is proud of this model as they have a direct role in its development. As such, the production-ready bike will be officially launched at the upcoming MForce Autoshow in May 2026.